I am a director and minority shareholder (10%) of a company (let's call it Business A), which we are winding up. It has not been active for 12 months.

I also became a recent shareholder (50%) in another company (let's call it Business B). I have been an employee of Business B for two years and recently became a director. I get my only income from Business B.

Will the above change our small business corporation (SBC) tax of Business B?

Pieter-Jan Bestbier, a director of auditing firm LDP, responds:

The requirements for a company to be deemed a small business corporation in terms of section 12E of the Income Tax Act is explained in Interpretation Note 9.

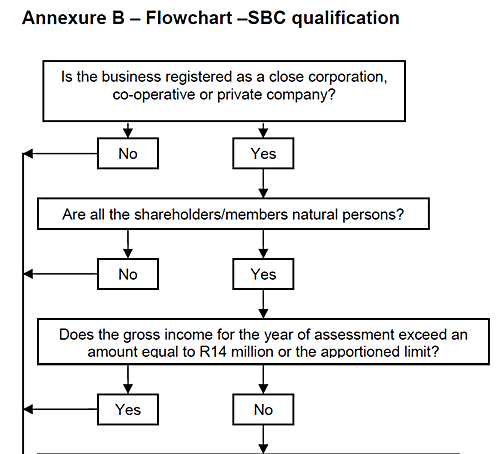

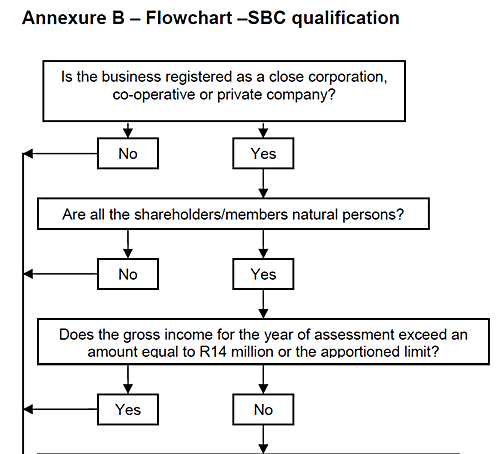

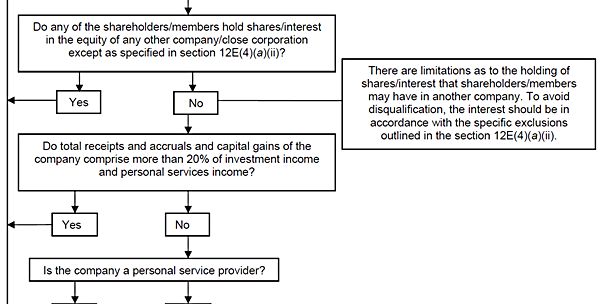

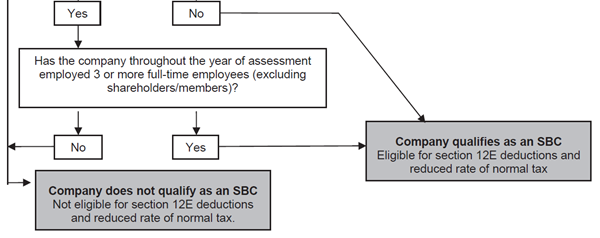

These requirements are summarised in the following flowchart (per Annexure B of the Interpretation Note):

(Supplied)

In order for Business B to qualify as an SBC, you will have to rely on the exclusion clauses of section 12E(4)(a)(ii). It will, therefore, depend on how far the process of winding up of Business A is.

Section 12E(4)(a)(ii)(ii) contains an exclusion in respect of investments in companies which are in the process of being wound up. The process must meet the requirements of section 41(4) in order to qualify for the exclusion contained in section 12E(4)(a)(ii).

It boils down to the fact that the shareholders of Business A must have done something formal in order to kick-start the winding up process.

If you have not done anything formally, such as passing the required resolution to wind-up or liquidate Business A, then Business B will lose its SBC status.

Disclaimer: Fin24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers. Under the ECT Act and to the fullest extent possible under the applicable law, Fin24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.